Money Workshops That Actually Work

Stop guessing with your budget. Our hands-on sessions give you practical skills you can use the same day—whether you're sorting out debt, saving for something real, or just tired of being confused about where your money goes.

Upcoming Sessions Through 2025

We run these workshops every few months across Sydney and surrounding areas. Pick what fits your schedule.

Budget Foundations

Learn the actual mechanics of tracking expenses without fancy apps. We'll use spreadsheets and old-fashioned paper—whatever works for you. Bring your last three months of bank statements if you want personalized help.

Debt Strategy Session

Credit cards, car loans, whatever's weighing you down. We'll break down snowball versus avalanche methods and show you how to negotiate with lenders. Real tactics, no judgment.

Emergency Fund Workshop

Most people need three to six months of expenses saved up. Sounds impossible? We'll show you how to start small and automate the process so you're not relying on willpower alone.

Smart Spending Habits

Where does your money actually go? We'll map out spending patterns and identify the sneaky subscriptions or habits draining your account. Plus practical tips for cutting costs without feeling deprived.

Tax Prep Basics

Tax season doesn't have to be chaos. We'll walk through deductions most people miss, show you how to organize receipts throughout the year, and demystify the whole filing process.

Long-Term Savings Goals

Whether it's a house deposit, car upgrade, or just building wealth—we'll help you create a realistic savings timeline and choose the right accounts to make your money work harder.

Who's Running These Sessions

Our facilitators aren't financial gurus preaching from ivory towers. They're people who've sorted out their own money mess and now help others do the same. Expect straight talk and practical advice.

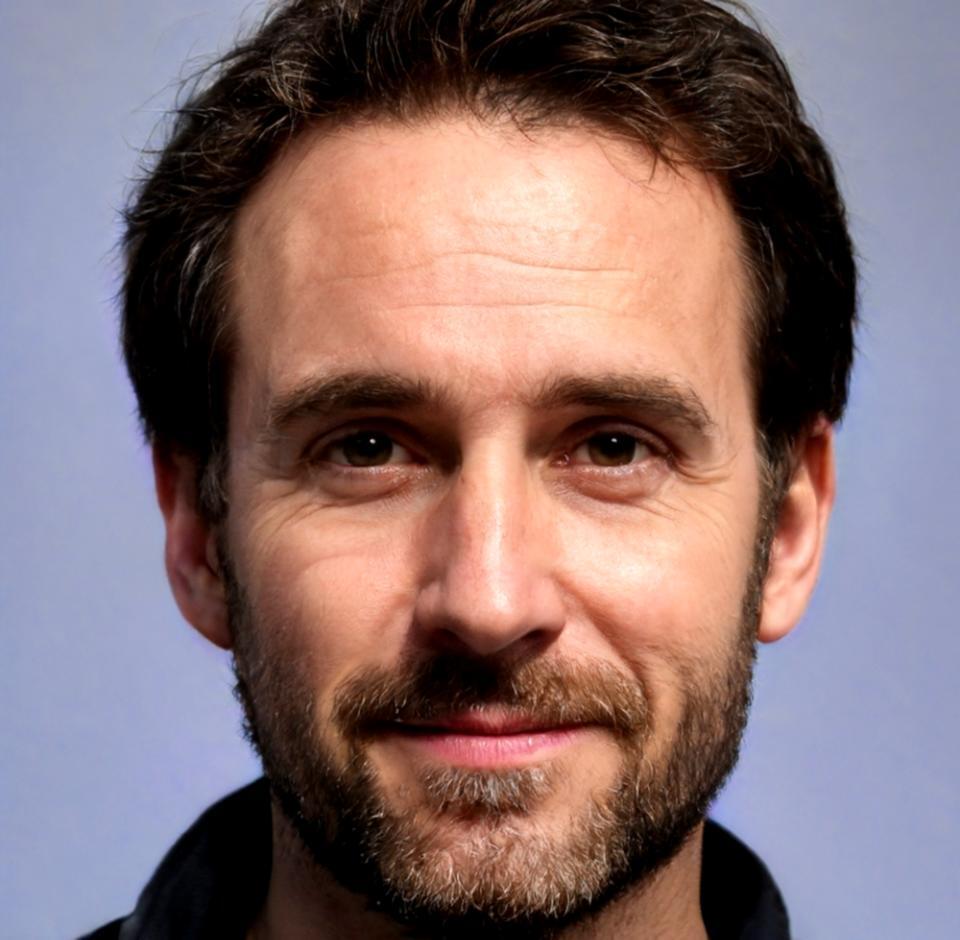

Callum Radcliffe

Budget Workshop LeadCallum paid off $47,000 in credit card debt over four years while working retail. Now he teaches the exact system he used—no magic tricks, just consistent habits and honest tracking. He's blunt about what works and what's just wishful thinking.

Sienna Kirkwood

Savings Strategy FacilitatorAfter watching her emergency fund save her when she lost her job in 2023, Sienna became obsessed with teaching others to build financial cushions. She focuses on small wins that add up—because saving $20,000 starts with saving $20.

Henrik Olofsson

Debt Reduction SpecialistHenrik helped his family navigate bankruptcy and rebuild their credit score from 480 to 720. He knows the system inside out and shares strategies that actually move the needle—not just feel-good advice.

What Happens at These Workshops

We keep groups small—usually 12 to 15 people—so there's time for actual questions. You'll spend about half the time learning concepts and the other half working on your own situation with guidance.

Bring a laptop or notebook. Some people prefer spreadsheets, others like apps, and a few still use the envelope method. We adapt to what makes sense for you, not what's trendy.

Sessions run about three hours with a break in the middle. We provide coffee and snacks, but grab lunch before you come. Location rotates between community centers in Nowra and occasionally Sydney—check specific workshop details when registering.

Ready to Get Your Money Sorted?

Workshops cost $45 per person, paid when you register. If you can't afford it right now, contact us—we have a few subsidized spots available each session.

Register for a Workshop